10 Jun 2024

Trends in accountancy in 2024: a snapshot

Behind the scenes, accountancy firms and business advisors are helping to keep the country operating. So many of the institutions and organisations that contribute to the economy and our society, are kept operational through sound business advice and support.

However, the accountancy sector itself also isn’t immune to being impacted by macro-factors such as the wider economic landscape, technological developments, and job market trends. These factors are constantly changing, and the finance industry must adapt not only in order to help the business community but also to stay competitive in the market. So, what’s been going on in the world of accountancy?

Skills shortages

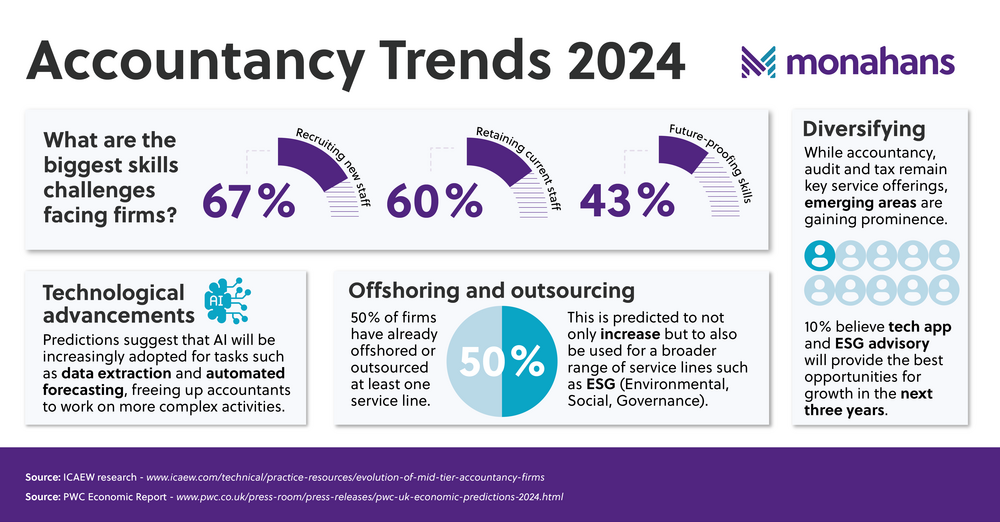

Accountancy organisations across the UK are struggling to hire the talent that they need. According to a ICAEW study of over 100 mid-tier accountancy firms, the second most significant trend identified by firms was a shortage of talent. When asked specifically about their top-three challenges around talent management, two-thirds (67%) agreed that recruiting qualified staff was one of the biggest issues, followed by retaining those staff (60%). Looking ahead, many firms (43%) also identified ‘future-proofing skills’ as a top talent challenge.

In order for accountancy firms to continue offering the best possible service to their clients, these skills gaps need to be plugged.

To do so, firms need to ensure that they are appealing to a wide range of candidates by clearly communicating the benefits that a career in accountancy offers and working to dispel the myths that often surround the field. For example, many still believe that you have to be exceptional at maths, when in reality skills such as problem-solving and strong communication capabilities are far more valuable to the role than algebra could ever be.

As candidates increasingly seek jobs that give them the opportunity to make a difference, accountancy should be included in that list. There is a misconception that the work isn’t meaningful, but accountants and business advisers make a huge difference to the lives of individuals and the success of small businesses, by providing them with invaluable support and guidance. Essentially, accountants get the privilege of playing a small part in the journey, which is extremely rewarding.

Firms see growth in diversifying

ICAEW research also found that many accountancy firms are choosing to diversify their service offerings in order to meet evolving business needs. While accountancy, audit and tax remain the primary service offerings, emerging areas such as tech app advisory and ESG are gaining prominence.

At least 10% of respondents identified ESG and tech app advisory as service lines offering the greatest opportunity for growth in the next three years.

Offshoring set to continue

In order to meet increased need and to offer a broad range of services, increasing numbers of firms are choosing to offshore certain service lines.

Half of ICAEW survey respondents confirmed that they have already offshored or outsourced at least one service line, most commonly: accountancy, tax, audit and payroll.

If done in the right way, offshoring work can be advantageous for all parties involved, including customers. At Monahans we began offshoring audit work because of the lack of audit resource here in the UK. Whilst our preference would be to hire in the UK, it is a strong employees’ market at the moment, making it exceedingly difficult to compete with other firms for such a small talent pool.

However, it was really important to us to choose a partner that would be the right fit for Monahans, not only for our employees, but also to ensure that our clients would be continuing to receive the very best service.

And there are benefits for our offshore partner too, such as gaining significant experience working with UK audit clients, with many wanting to expand their knowledge on financial reporting requirements here in the UK.

Technological advancements

We’re expecting to see Artificial Intelligence (AI) having a significant impact on the accounting industry over the next 12 months. With some predicting that it will be increasingly adopted for repetitive tasks such as data extraction, data entry and invoice processing.

The hope is that it will free up time, allowing accountants to focus on more complex, value-added activities that require human intuition and expertise, as well as helping to minimise human error. Watch this space!

Economic outlook

PwC recently unveiled its economic forecast for 2024, offering a more optimistic perspective on the economy as the UK continues to recover from challenging post-pandemic years. Its key points include headline inflation nearing the 2% target and living standards improving for low-income households.

That said, the report also forecasts that consumer prices will sit about a quarter above early 2021 levels and that corporate insolvencies will continue to rise.

Government legislation also significantly impacts the finance and accountancy sector, so with a general election on the horizon, at Monahans we’ll be ensuring that our clients are kept up to date with any financial changes or announcements that they need to know about.

If you need any guidance around how rule changes might affect your financial circumstances, please do get in touch today. We’d love to hear from you.

Martin Longmore