28 Feb 2023

Exiting your business: what to consider this quarter.

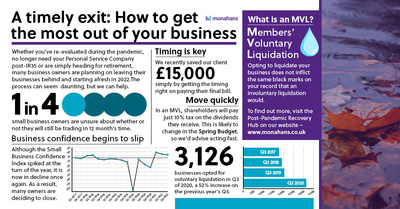

Financial uncertainty in recent times, combined with rising costs and fluctuating government policies, has prompted some owners to consider an exit from their business. Although for some this will be a financial necessity, for others this might take the form of a solvent liquidation (Members’ Voluntary Liquidation, also commonly known as MVL) for as simple a reason as a business owner deciding to retire or take their money out for other purposes.

For those who are considering their options, as with all financial decisions, information is key. The process of solvent liquidation is impacted substantially by the wider economic climate. Shifting financial legislation and tax regulation, for example, can have far reaching implications on the outcome of the process, so being aware of what is relevant to you is paramount.

Of course, knowing what future government budgets and statements will bring is anyone’s guess. With that in mind, if voluntary liquidation is a direction you are looking to take, doing so before the upcoming budget announcement or at least prior to the financial year end is highly recommended, simply to know what lies ahead.

Here at Monahans we are expecting to see an uptick in MVL enquiries in March. We are therefore encouraging anyone already moving down this path to come and see us as soon as possible to chat through their options.

So, what do you need to be aware of when selling your business?

You may be eligible to pay less Capital Gains Tax when you sell (or ‘dispose of’) all or part of your business via Business Asset Disposal Relief, formerly known as Entrepreneurs’ Relief. This relief means you’ll pay tax at 10% on all gains on qualifying assets.

How much tax you will be liable for will depend on whether all your gains are eligible for Business Asset Disposal Relief. If they are, you will be required to work out the total taxable gain that’s eligible, deduct your tax-free allowance and pay 10% tax on what’s left.

Another change of note has been the reduction of the lifetime limit of Business Asset Disposal Relief from £10 million to £1 million for qualifying disposals made on or after 11 March 2020.

These rules, like others, can be overturned, and whilst any changes can be adapted to, if you can head into the process with a clear view of the terrain ahead, it is far more likely to be a straightforward experience.

Why are insolvencies rising?

In the business community, some who managed to survive the pandemic by remaining adaptive, making use of loans and grants and, above all, staying determined are now considering the prospect of insolvency. This is partly due to the delayed impact of the pandemic. Some are facing higher tax liabilities owing to the timing of grants, or are struggling to pay back government loans, accentuated by rising business costs.

In England and Wales, the number of registered company insolvencies in December 2022 was 32% higher than in the same month in the previous year and 76% higher than three years previously.

However, although the numbers of insolvencies are steadily rising, we haven’t yet witnessed a big explosion of cases. A fact we feel can largely be attributed to the government support helping many businesses to operate through this period, and enabling some to hang on a little longer than they may have otherwise.

On top of this, in light of unprecedented circumstances HMRC hasn’t been pressing people to the same degree as is customary, allowing businesses slightly more breathing space.

As a result, it has taken longer for some directors to ‘fall over’. But as HMRC becomes more productive, the pressure increases and loans become due, we’re likely to see winding up processes increase.

The common theme for many of those we interact with is that the core business is good, but lingering legacy debt in the form of support loans or COVID grants is restricting growth. For some this might be the catalyst to decide to phoenix their business, offload their debt and start again.

Pressure is beginning to be felt at the smaller end of the market and predictably it's those who are least well off that will suffer the most. In the South West specifically, we are witnessing insolvencies on the rise. But far from being doom and gloom, we are encouraging clients to speak to their accountants and business advisors, rather than avoid the subject. For one, they may be able to show you options that circumnavigate insolvency, or if that is your decision, take some of the sting out of the process.

At Monahans we provide a friendly, approachable service and understand all of the real and potential implications of your business decisions, helping to build a complete picture of your financial profile. Finding the best solutions for our clients in what can be a stressful time of their lives and being able to offer that personal and human service, is the reason that we work. Get in touch today.