Services

Research and Development Tax Reliefs

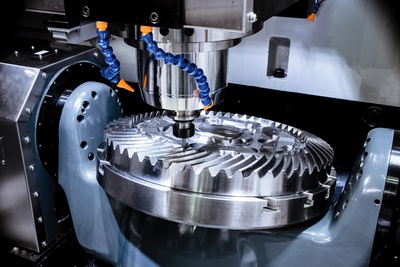

The Patent Box (IP box) and Research & Development (R&D) tax relief schemes are corporation tax incentives designed to stimulate innovation and development in the UK. Companies in a wide range of industries may be eligible for R&D tax relief and credits if they are developing new processes, products or services and have made an appreciable advance in knowledge or capability in a field of science or technology through the resolution of uncertainty.

For examples of qualifying Research and Development activities, please click on the relevant sector category panel below.

To discuss R&D tax reliefs further, please contact Dominic Bourquin or Stephanie Hurst.