22 Feb 2022

Four things charities need to know about Gift Aid

Though we appear to be coming out of the other side of the Covid-19 pandemic, the hard work of recovery is still ahead of us. The Chancellor’s Autumn Budget was less austere than many feared, but with government debt at its highest levels since the 1960’s. it seems probable that harder times are around the corner. This means it’s more important than ever for charities to get their finances right.

Recently, I’ve been working with the Wiltshire Community Foundation to help identify some of the areas charities should consider, when looking at their financial health. First up: Gift Aid.

What is Gift Aid?

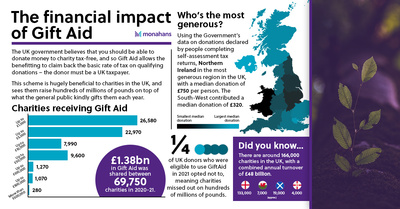

Most charities, as well as some other organisations such as community amateur sports clubs can make use of Gift Aid. The UK Government believes that people should be able to donate money to charity tax-free, and so for qualifying donations, charities can claim back the basic rate of tax. At the current rate of tax, that means an extra 25 pence for every one pound received.

What income can charities use to claim Gift Aid?

The simple way to look at it is that Gift Aid can be claimed on any income which is given in return for no benefit. The donor must also be a UK taxpayer and the charity must be able to demonstrate this.

There are some exceptions and complications to this rule – for example certain visitor attractions can claim Gift Aid back on income made from admittance. Some charity shops can also claim back Gift Aid on items the public have donated. We recommend consulting a professional for advice if you are unclear on what income qualifies, or take a look at our video which goes into a little more detail.

Get it right, HMRC is watching

When HMRC initially makes a Gift Aid payment to a charity they will only run limited checks. This is because they want to avoid long delays, in getting the money to the good cause. However, it does not end there, HMRC do periodically select some charities for an audit where more detailed analysis will be undertaken.

It’s important to note that even if you have used Gift Aid perfectly legitimately, the process of an HMRC enquiry can be lengthy and expensive. HMRC are often prepared to go back several years, so it’s really important to be prepared with adequate accounting records. Gift Aid records must be held for at least six years after the end of the tax year they relate to, or 12 months after making the gift aid claim if this is later.

We’ve detailed the need-to-know on tax investigations in a previous article, which you can read here.

It’s worth the extra steps

Recent research revealed that charities are missing out on hundreds of millions of pounds in Gift Aid. That money could make a huge impact to charities, particularly as fundraising becomes more challenging as members of the public grapple with rising costs of their own.

There are lots of useful guides available if you need advice. HMRC has provided detailed guidance, and the Charity Tax Group have some great information on their website. Please do contact us here at Monahans too if we can help support you.

We’ll be working with Wiltshire Community Foundation to bring more advice for charities with videos filmed by the brilliant The Platform Project. Follow us on LinkedIn and Twitter to ensure you don’t miss out.

For more information on Gift Aid, take a look at our video produced by The Platform Project and presented by us and the Wiltshire Community Foundation. If you have any questions or to discuss your charity’s finances, please get in touch

James Gare