8 Sep 2020

HMRC announces changes to digital advertising VAT rates for charities

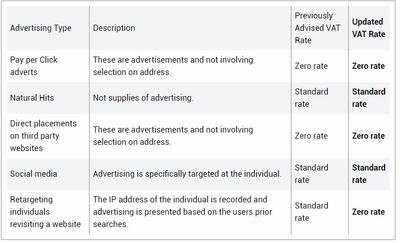

Following a campaign by the Charity Tax Group, HMRC has agreed to change its policy on VAT rates applicable to digital advertising. Previously HMRC stated that certain supplies of digital advertising did not fall into the zero rating relief available for charities because the supplies were targeted advertising. They have now reconsidered certain types of digital advertising and decided that they are in fact zero-rated. Charities should note, however, that some types of digital advertising remain standard rated.

UPDATE (08/09/2020):

HMRC has subsequently published further guidance on this point, see here.

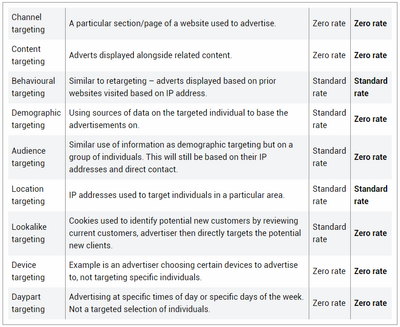

In a welcome development, HMRC now accepts that ‘Location Targeting’ as defined in the Guidance, is also within the zero rate, having previously taken the view that this remained standard-rated.

The Brief concludes by inviting claims for overpaid VAT by suppliers, and charities may wish to encourage their suppliers to do so, enabling them to refund the overcharged VAT to affected charities.

Charities should now review the VAT rate applied to advertising supplied to them over the last couple of years and where the rate has changed, ask suppliers to issue credit notes for advertising previously treated as standard rated which can now be zero rated. This could result in significant VAT savings for the organisation.

Where a charity buys services from outside the UK, it must account for VAT on the cost of those services if they are standard rated under a procedure known as reverse charge. Charities therefore should check the VAT rate applied to reverse charges on services purchased from outside the UK and make a reclaim of VAT if they have accounted for reverse charge VAT on services which HMRC now accept can be zero rated.

The tables below show the VAT rate previously advised by HMRC and the new revised VAT rate.

Other targeted advertising:

If you would like further advice or guidance regarding how this will affect your organisation and what you should do, please do not hesitate to contact a member of our specialist, Steve Chamberlain.