27 Jul 2023

Why are business insolvencies rising?

Owning a business in the current climate is no mean feat. The road to recovery since the global pandemic has been challenging. Many have struggled with supply-chain issues, sky-high energy prices and historical debt, which has inevitably caused impactful strain on business owners. Some have ploughed through the obstacles whilst many have simply had enough and turned to voluntary liquidation.

As anticipated earlier in the year, the business recovery and insolvency industry have experienced waves of new business as the future trajectory looks at rising liquidations.

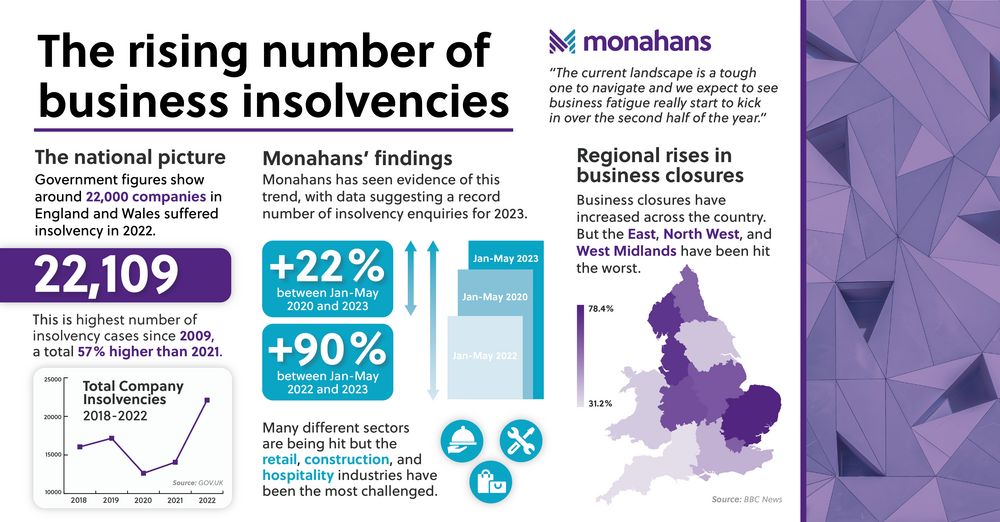

To paint the picture, national figures released byThe Insolvency Service have shown a rise in liquidations across the UK in the last year compared to the year before the pandemic. We echo this research, having seen a sharp 90% increase in enquiries for corporate insolvency compared to last year at Monahans.

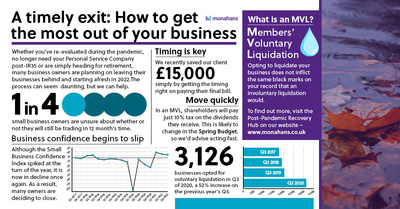

It is no surprise that accountants are facing the highest number of insolvency cases since 2009 in England and Wales. A key factor for the significant rise is HMRC’s amplified pressures to pay back loans, after playing a more relaxed approach during the years following the pandemic. Small businesses in particular are being hit from all angles which is leading to depleted levels of resilience, with many turning to voluntary liquidation as they see no other option.

Business fatigue is becoming the result of business owners’ endless battles. We have seen multiple cases of owners working extremely hard to get through the last few years and even though their businesses are starting to do well again, a lot of their profit is being sapped by the backlog of debt and bounce back loans.

There is difficulty across the board, but construction, retail and hospitality seem to be the hardest hit industries. Smaller companies within construction have been struggling due to larger firms not paying efficiently, causing a number of problems down the line. Brexit has added another layer of pressure to supply chain and stock levels as resources may be coming from European countries. Finally, staffing challenges often impact hospitality the most and combined with eye watering energy bills, it’s a tough pill to swallow.

Predictions suggest that high inflation levels will last for another year and with that comes increased interest rates. If they haven’t already, business owners need to brace themselves for staff demands of increased staff wages to account for the cost of living crisis, the rise in price of materials and obstacles of supply chains.

It’s not all doom and gloom for everyone. For those who are eager to continue working, support is available to help gain control and stability. We often assist businesses in managing their cashflow, building realistic plans to pay back any debts or overheads in addition to liaising with HMRC to get them on track to brighter days.

As always, our advice at Monahans would be to act quickly if you are experiencing any struggles as there are a lot of steps that can be taken to steady the boat. Businesses are advised to carefully assess their short-term strategies and should speak to an expert for help in creating a robust plan to sustain their business, advice on tackling debts or for assistance in closing a business.

If you need support, or just want to talk through your options with one of our experts, reach out to us today. We provide real, practical, down-to-earth advice on how to tackle your problems, including help with restructuring debts and negotiating informal arrangements with creditors. https://www.monahans.co.uk/services/business-recovery-insolvency