22 Feb 2024

Navigating Financial Challenges in Academies

Academies do not operate on a “for profit” basis, so reporting an in-year deficit is not necessarily a huge issue. We might expect schools to build reserves one year and expend them the next. Provided their free reserves stay within a reasonable level, this ebb and flow is to be expected.

Although the overall national results for the sector have not yet been collated, the initial impression is that more Trusts were required to eat into their reserves to make ends meet last year. We have seen this in our direct experience of working with Academy schools in the South West, but other auditors we speak to nationally seem to be indicating a similar picture.

Furthermore, we had to report a material uncertainty in relation to ongoing concern in around 10% of the Trusts we worked with this year, which was a much higher proportion than in the past.

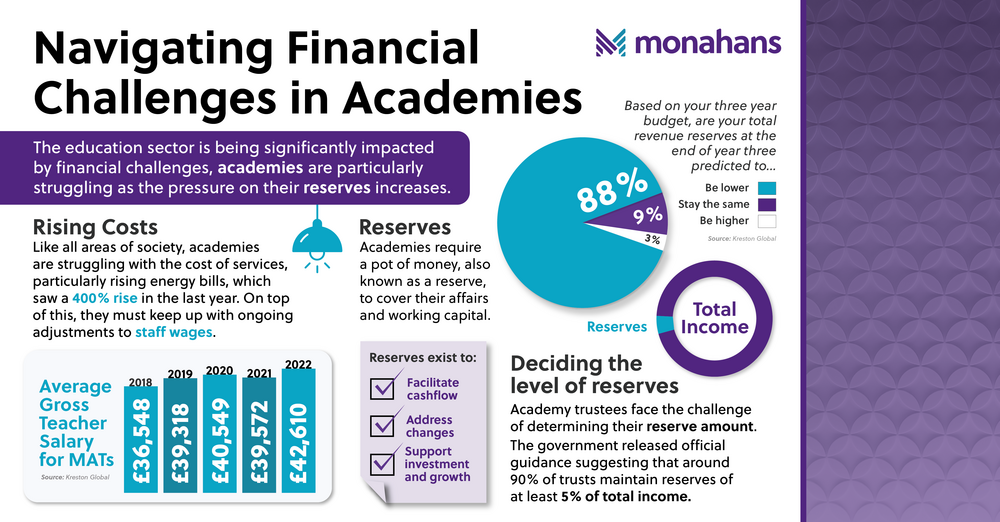

In fact, as we move into 2024, the financial challenges faced by academies as the pressure on their reserves increases, are threatening to impact the education system. With a 400% rise in energy bills last year and ongoing adjustments to teaching staff wages, the strain on reserves is evident. While there's no magic solution, our team can provide expert advice and support to help guide academies through this uncertain future.

The significance of reserves

Academies require a pot of money, also known as a reserve, to cover their affairs and working capital. The money serves to facilitate cashflow, address unforeseen changes, and support planned investment and strategic growth.

Determining the appropriate level of reserves has been a longstanding debate, and there is no one-size-fits-all solution. Striking a balance is the ultimate goal - academies don’t want to have a large chunk of money sitting in a bank untouched, but having too little may jeopardise smooth operations.

Deciding the level of reserves

Historically, academies have faced the challenge of determining the necessary reserve amount themselves. The ESFA (Education and Skills Funding Agency) has never set a required level, emphasising that trustees should decide based on their trust's circumstances and priorities.

However, in November 2023, the government released official guidance for the first time. The guidance suggests that approximately 90% of trusts maintain reserves of at least 5% of total income. In our experience, many opt to hold about one month's salary costs or expenditure (usually 6-8% of income) to ensure cashflow remains steady.

While some trusts may maintain reserves below this level, particularly those which are larger and do not have significant investment plans, careful consideration is key when making decisions. When considering a minimum reserve level at the lower end, trustees must ensure there is adequate contingency for unforeseen circumstances and that funds are available for maintaining the school estate and infrastructure.

How accountants can help

Although the Government’s advice helps provide a steer as to what might be a suitable figure, the responsibility remains with the academy to choose the option best for them.

Holding reserves below 5% might indicate financial vulnerability and pose a challenge, so we would advise against this, if avoidable. If there is no other option, academies will need to look into ways they can trim costs. For example, stand-alone trusts may consider joining a Multi Academy Trust (MAT) to gain better financial stability, as joining forces in this way typically strengthens reserves.

At the upper end of the spectrum, trusts opting to accumulate high reserves, defined as 20% of income or above, typically do so for specific needs, such as upcoming contributions to capital projects. But unless there is good reason for holding such high reserves, it should be avoided.

In many cases, the trustees who are responsible for determining the amount of reserves an academy holds do not feel that they have the experience or knowledge necessary to make an informed decision. This is often the case in smaller primary schools as they can struggle to find financially literate trustees and therefore need input from a professional to ease the pressure.

Financial professionals can help to plug this knowledge gap, providing trustees with the information and insights necessary to take the steps needed to future-proof their organisation. At Monahans, the consultative aspect of our work is just as important as the technical, and much of our value comes from acting as a sounding board and giving our clients reassurance that they have an expert with their best interests at heart.

As we head into a new year which may bring more uncertainty to the education sector, Monahans is here to provide expert advice that will empower academies to tackle any challenges head on and create long-term solutions. To understand the best route for you, contact me directly for help and advice or complete our form for more information.

James Gare