Monahans P11D Guide 2024

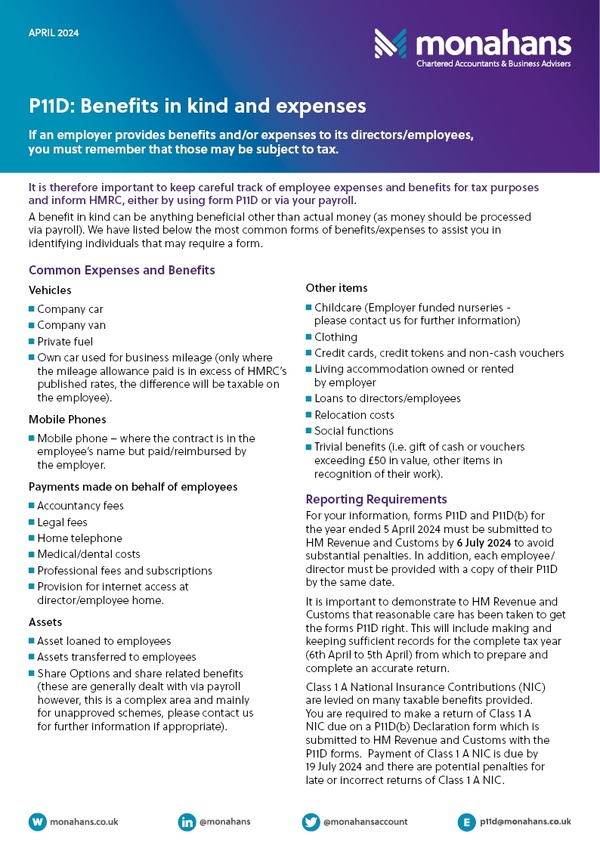

If an employer provides benefits and/or expenses to its directors or employees, they must remember that these may be subject to tax. It is therefore important they keep careful track of employee expenses and benefits for tax purposes and inform HMRC, either by using form P11D or via their payroll.

A benefit in kind can be anything beneficial other than actual money (as money should be processed via payroll). Our P11D Guide lists the most common forms of benefits and expenses to assist you in identifying individuals that may require a form.

Download our PDF to find out more.

Download publication