17 Nov 2022

Autumn Statement 2022: Tighten your belts

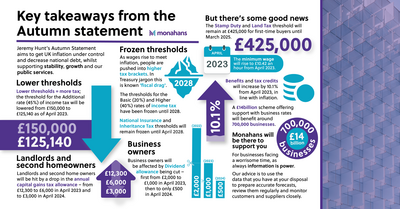

Jeremy Hunt today announced a raft of measures that should see the Government £55bn better off. Just under half of this will come from increased taxes, with the highest earners most affected as they are forced to start paying the 45% rate of income tax at a lower threshold – £125,140 rather than £150,000. This will bring in £80 million in 2022-23, rising to ten times that in 2027-2028.

But that’s the thing with fiscal drag, which is a by-product of inflation; as the cost of living rises and wages are increased to attempt to match this and help people through turbulent financial times, we all end up paying more taxes.

Yes, ‘ALL’ – because, make no bones about it, even though Hunt’s ‘Robin Hood’ tax measures are aimed at having those who earn more pay more, the freezing of income tax and National Insurance thresholds – currently frozen until 2025-26, now extended by two years until April 2028 – will see us all pay more tax. And hidden away in the announcements was the fact that the lowest rate of income tax will no longer be dropped from 20% to 19% (as per Kwasi Kwarteng’s mini-Budget of September), which will cost the tax payer £6bn a year.

In fact, in a rather un-Tory-like move, it’s a complete reversal of the mini-budget, which would have been the biggest tax cut in the UK for 50 years. Instead, it’s the highest tax burden for 70 and the OBR predicts that household incomes will shrink by 7% over the next two years.

Needs must, unfortunately, if Mr Hunt is to stay true to his three-pronged attack of supporting stability, growth and our public services. Stability will come when inflation drops, and, as Mr Hunt pointed out, ‘You cannot borrow your way to growth’.

Yet, I was astonished that by 2027-2028 the government will still be borrowing £70bn each year. This smacked all the harder when Hunt claimed, “We’re a government that doesn’t leave its debt to the next generation.” Not so, Mr Hunt – it’s our children that will be paying for our current deficit if we continue borrowing, even if the amount of borrowing is decreasing.

And the old adage rings true; 'The one hand giveth; the other hand taketh away.' What was a gloomy first half of the Budget announcement was then quashed by what seemed like benevolence – benefits rising with inflation, higher National Living Wage, triple lock on state pensions maintained, stamp duty cuts remaining in place – but we mustn’t lose sight of the overall message that we’ll all be out of pocket.

Businesses too. A freeze on VAT thresholds will see more small businesses dragged into paying VAT, £25bn raised by 2028 through freezing employer National Insurance thresholds and a £14bn tax cut on business rates – benefitting about 700,000 businesses – is unlikely to be enough to counteract changes in consumer behaviour as belts are tightened. Business owners will also pay more tax as dividend allowances are lowered.

As things stand, Jeremy Hunt’s job is to pull as many feathers out of the bird with the minimum amount of squawking. And a billion here, a billion there – frozen thresholds on income tax, National Insurance and inheritance tax and lower allowances on capital gains tax and dividends, taxes on electric vehicles from April 2025, windfall taxes, more stringent taxes on big corporations – will seem almost stealth-like. The trouble is every single taxpayer in this country will be worse off as a result.

For businesses facing a worrisome time then – the Chancellor also acknowledged that we are in a recession, even though another objective of the Budget was to achieve a ‘shallower downturn’ – our advice is to use the data that you have at your disposal to prepare accurate forecasts, review them regularly and monitor customers and suppliers closely.

And if you need a helping hand along the way, Monahans will be there to support you.

We have produced a concise report on the key announcements from the Autumn Statement, you can read and download it here.

Dominic Bourquin