9 Oct 2023

Basis Period Reform: How could it affect you?

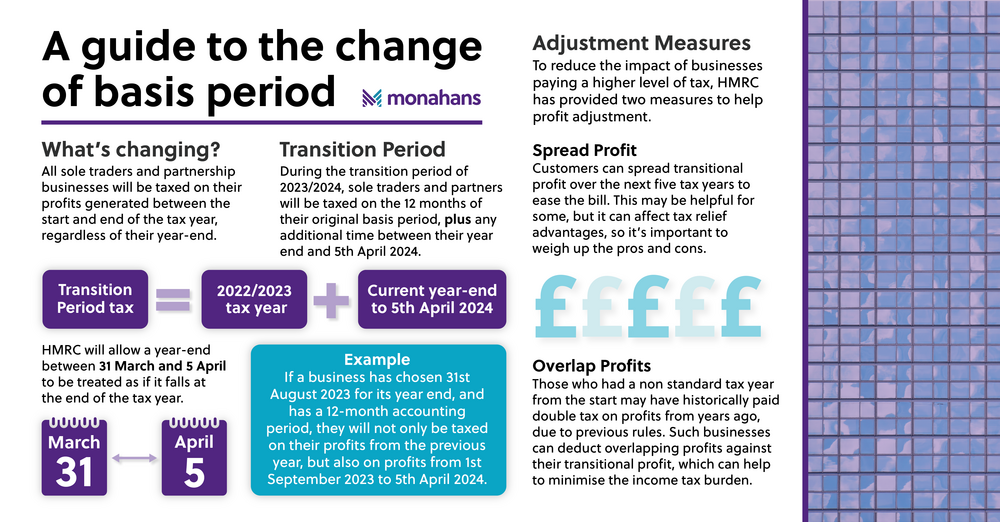

If you are a sole trader or partnership with an accounting period which does not align with the UK tax year, the way in which your annual profits are taxed could be changing due to the implementation of reforms to the basis period rules.

Where are we now?

Self-assessment was first introduced in 1996 and ever since then, unincorporated businesses (i.e. sole traders and partnerships) have been required to disclose their trading results on a ‘current year basis’.

Very broadly, profits from unincorporated businesses have historically been taxed based on the fiscal year in which an accounting period falls. Taking an example, profits arising from accounts made up to a 31st August 2022 year end would be subject to tax during the tax year ending 5th April 2023 despite some of those profits falling into the previous tax year.

Those businesses with an accounting period that does not align with the tax year have been subject to quite complex rules, particularly in the first year of trading, and the misalignment of accounting periods to the tax year has been known to complicate tax planning measures that individuals may want to put in place.

What is changing?

It was initially announced in the 2021 Autumn Budget that a change to the taxation of business profits was coming, primarily to align with the introduction of Making Tax Digital for Income Tax Self Assessment (MTD ITSA) in April 2024.

The key motivation was to create a clear and transparent set of rules to make MTD ITSA less onerous for businesses. Although the movement to digital taxation has now been delayed to 2026 and beyond, the basis period reform rules did not follow suit.

With effect from the tax year ended 5th April 2025 all unincorporated businesses will be subject to tax on a ‘Tax Year Basis’. This essentially means that all sole trade and partnership businesses will be taxed on profits they have made during the tax year regardless of their accounting period.

To allow for the rules to take full effect in the 24/25 tax year, a transition to the new rules will occur during the year ended 5th April 2024.

Transition period – how will this work?

During the tax year ended 5th April 2024 all unincorporated businesses will be assessed on the following:

- Profits from the accounting period that would have usually been assessed under the current year basis

- Any profits arising after the accounting period up to 31st March or 5th April 2024 – this is known as the ‘transition profit’

Using the above example of the 31st August year end, a business would normally be taxed on profits for the year to 31st August 2023 in the 23/24 tax year because that would be the accounting period that ends in that year.

Whilst this is still the case, businesses will also be taxed on profits from the 1st September 2023 all the way up to 5th April 2024 in order to transition to the new rules. This means that all unincorporated businesses who do not have an accounting period ending on 31st March or 5th April are likely to be subject to tax on more than 12 months worth of profits in the 23/24 tax year.

To reduce the impact of this, HMRC have provided two measures that will help with the transition and profit adjustment.

Overlap Profits

As mentioned above, businesses with a year end that does not align with the tax year may have been subject to double taxation on a proportion of their profits when the business first began. Profits subject to this taxation are known as “overlap profits” and may be carried forward indefinitely until such time that they may be utilised.

Businesses with unused overlap profits will be able to deduct these from their results for the 23/24 tax year which should ease some of the tax burden. If you don’t know if you have any overlap profits you are now able to request this from HM Revenue & Customs using an online form.

Spreading Relief

HMRC have given the option to those affected by the basis period reform rules to spread the chunk of transition profit over the next five tax years to ease the tax burden and allow businesses to retain a positive cash flow.

This may be a helpful option for some, particularly where transitional profits have a detrimental impact on claiming certain reliefs such as the personal allowance. However, each case will be different and taxpayers should evaluate their options.

Whilst HMRC have confirmed that the presence of transitional profits will not have an impact on the high income child benefit rules or tax-free childcare threshold, it is understood that they will affect the personal allowance which could potentially be tapered if income exceeds £100,000.

What do I need to consider?

There is no one size fits all answer – every taxpayer affected by these changes should review their position to understand the impact and to decide how best to deal with any transitional profits arising. Businesses affected by the basis period reforms will also need to consider if they want to retain their current accounting period or align it with the tax year.

In an ideal world, our recommendation for businesses would be to change their year-end to either 31st March or 5th April as it will fall in line with the end of the tax year, making things easier from a tax and administration point of view. However, commercially speaking, this change won’t necessarily be easy for businesses in seasonal sectors such as tourism, leisure and farming.

To put the basis period reform changes into perspective, HMRC say that 93% of sole traders and 67% of partnerships are already on a standard (31st March to 5th April) year end. We generally tend to find that many farming businesses are partnerships with accounting periods that are in line with harvest periods so these types of businesses may find the impact of these changes particularly tricky to navigate.

At Monahans, we will be contacting our clients to discuss the changes and to provide them with the different options available to help navigate the upcoming year.

Stephanie Hurst