12 Jul 2022

Family Business Advice

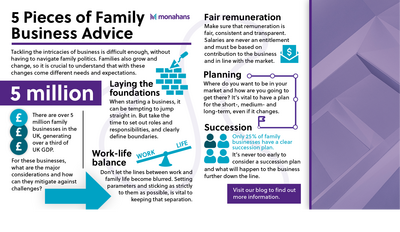

Tackling the intricacies of business is difficult enough, without having to navigate family politics. Bcut, with over 5 million family businesses in the UK, generating over almost a third of UK GDP, this is a crucial section of industry. Working with many family businesses here at Monahans, we are careful to take the necessary time to understand their needs as a business, but also as a family – let’s not forget the importance of the individuals involved. Families also grow and change, so it is crucial to understand that with these changes come different needs and expectations.

For these businesses, what are the major considerations and how can they mitigate against challenges?

Laying the foundations

When starting a business, it can be tempting to launch straight into setting up a limited company but in the case of families, owners need to think about family members and their involvement within the business. Relationships are potentially at stake, so any repercussions must be carefully considered, and boundaries clearly defined. Setting out roles and responsibilities early can help avoid conflict further down the line.

Work-life balance

Arguably the biggest challenge faced by family businesses is building a healthy level of work-life balance and avoiding work and personal lives becoming intertwined. With the pressures of getting the business to a place where it can provide for the family, the situation can arise where the lines become blurred between what denotes ‘work’ and what denotes family life.

Working within the family home can make this distinction even harder and in the case of husband-and-wife teams, for example, it can be tricky to devote time to life outside of the business. Setting parameters of where you work and when you work, and sticking to that as strictly as possible, is vital to keeping that separation.

Furthermore, communication and involvement are key to the success of any organisation, but even more to the smooth running of a family business. Employees always want to know what’s going on and this is even more important where family members are concerned and there is a greater emotional attachment. In this scenario, communication is not just informing, but also listening. People want to feel empowered; like they’re able to express their opinions, put forward their ideas and offer their feedback. They also want to feel like their comments will be taken on board and actioned. In doing so will only improve creativity, whereas not doing so will likely stifle it, as people ‘clam up’ in the fear of being ignored.

Fair remuneration

Remuneration is an area that can easily cause feuds and it is crucial to get this right, from paying fairly to paying in the most tax efficient way. Family businesses can explore avenues such as paying members a lower base salary – sufficient to maintain national insurance contributions, whilst coming under the threshold for income tax – and making up the difference in dividends. There is a dividend allowance – on which you don’t pay tax – and then a varying rate of tax as dividend payments increase, while pension contributions reduce the amount of corporation tax a business must pay. Looking at the whole remuneration package is therefore a valuable exercise and Monahans can help to find the best way for this to work across your business.

Most critical is that remuneration is fair, consistent and transparent. Salaries are never an entitlement and must be based on contribution to the business and in line with the market. It might be that you do some research across the market or get third party advice on salaries.

Planning

Family businesses can get into the dangerous habit of making things up as they go, without taking the future into consideration. As the focus lies firmly on making ends meet in the here-and-now, they can be short-sighted to what may lie ahead.

But it’s important to have a plan, so I always ask my clients, ‘Where do you see yourselves in five years’ time?’ I want my clients to consider where they want to be in their market and how they’re going to get there. What growth do you envisage, what turnover do you want to achieve, what resources do you need to make that work, what extra equipment, what extra staff? How are you going to finance that equipment? How are you going to find those staff or train them?

Covid has affected businesses’ timelines, putting more emphasis on the short-term, but it’s vital to have a plan for the short-, medium- and long-term, even if it changes. Monahans can help with areas such as business strategy, finding finance, managing cashflow and forecasting, all to support long-term planning.

Succession

It’s never too early to consider a succession plan and what will happen to the business further down the line. Even in the early days, when setting up and talking about roles and responsibilities, having an idea of how the business will run without you, is good for your peace of mind. Bear in mind, this is not an entitlement, so looking at the skills of the individuals within the business and determining what’s needed is essential for future success, rather than putting a family member in a role that they're not suited to.

What’s more, while it may not be a nice topic to address, unexpected events do happen, so, having a plan in for the worst-case scenario is always worth your while.

For a range of family business advice speak to our friendly team today we’d be more than happy to help.

Lynette Whitcombe