28 Mar 2022

Making Tax Digital Phase 2

In 2019, the UK saw its first wave of Making Tax Digital (MTD) rules come into force. Anyone who was VAT registered and with Taxable turnover in excess of £85,000 in a rolling twelve month period, was required to make changes to how they filed their taxes.

They key changes included:

- Keeping digital records in an approved third-party software

- Filing returns digitally via software with API interface

- Maintaining a record of daily figures

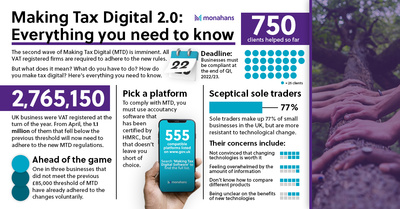

Now on the horizon is the second round of MTD, which is applicable to any other VAT businesses who did not fall into the 2019 tranche. As of 1st April 2022, all businesses which are VAT registered are required, by law, to comply with MTD rules.

During the first wave HMRC offered a ‘soft landing’ period to all businesses having to change to filing digitally. This gave businesses time to get their systems in place, a soft approach to fines as well as the opportunity to copy and paste information into their VAT return. This appears to be a luxury which those affected by the April 2022 changes don’t have, unfortunately.

So, what else should those preparing for MTD 2.0 be aware of?

The system you use must be compliant

Anyone who falls in the new regime must keep their records on a digital system with digital links from the source data to the VAT return figures used for the VAT submissions to HMRC. The easiest option is to invest in an online Accounting System such as Xero, Quickbooks or Sage. These systems not only make you MTD compliant but offer the additional benefits of tracking debtors and creditors, regular financial reporting and by using the bank reconciliation tool it will ensure that all items via your bank are tracked and recorded.

Paper records are no longer viable options for your bookkeeping, all transactions must be kept on a functional, compatible platform that can record transactions digitally and ‘talk’ to HMRC via an Application Programming Interface (API).

In addition to the systems mentioned above there are hundreds of online systems to help you keep digital records, but how do you know which ones are both effective and compliant? Thankfully, HMRC has put together a full list of allowed software, which you can find here.

All transactions must be recorded daily

Don’t worry – we don’t mean that you have to go in every day and record your finances (even though if you can, that would be best), but all transactions must be allocated to the correct day of the week. Once you have adopted MTD you won’t be able to put the entire week’s earnings and outgoings into summarised figures. Each transaction needs to be recorded and noted on the day it took place.

To make this possible, we recommend that you review your systems to ensure they can provide you with daily reports, rather than the weekly ones.

One saving grace for Retail businesses that see high volumes of transaction is that each sale doesn’t need to be entered into the Accounting system provided their till systems record these transactions.

Don’t be tempted to copy and paste

Another element is that the requirement to transfer data between different pieces of software must be a digital link. You can’t re-key or copy and paste. For example, if you’ve got a stock system where you keep all your purchase invoices, that system must have a digital link to the system that will file your VAT return. Similarly any use of Excel spreadsheets must contain links between data

Go back to basics

All businesses who fall inside MTD rules must have a digital record of simple things such as the business’ name, address, and VAT registration number. When you make a sale, the following must be recorded digitally:

- The tax point

- The value of the supply (net)

- The amount of the VAT charged

Similar information must be gathered when you receive supply:

- Date of purchase

- Net value

- Amount of tax being claimed

While most online platforms will force you to do this when you input transactions, some may not – so it’s worth being aware.

Don’t leave registering until the last minute

Leaving anything until the 11th hour is always going to be risky business, but it’s even more crucial that this doesn’t happen when it comes to registering for MTD.

If this is left until June 30th (the end of the first quarter these businesses come into MTD), businesses won’t be complying with the regular daily recording of transactions, and they run the risk of being penalised by HMRC.

Most sole trader businesses will have a year-end of either 31st March or 5th April: this is a great opportunity to not only be compliant for MTD but to change the entire way in which your business functions – for the better. From recording your invoices and tracking you debtors, to having more effective cashflow management and greater insight into the company via data capture, there’s no time like the present to streamline your operations.

To date, Monahans have helped over 750 clients effectively prepare for MTD, helping to take the burden from their shoulders. While it may seem that this change is a chore, it is in fact an opportunity. It’s an opportunity to help your business flourish with greater understanding of your finances and more control over your incomings and outgoings.

If you need support before the 1st April MTD deadline, get in touch with one of our advisors today.

Clare Bowen