8 Dec 2023

New Year, New Rules

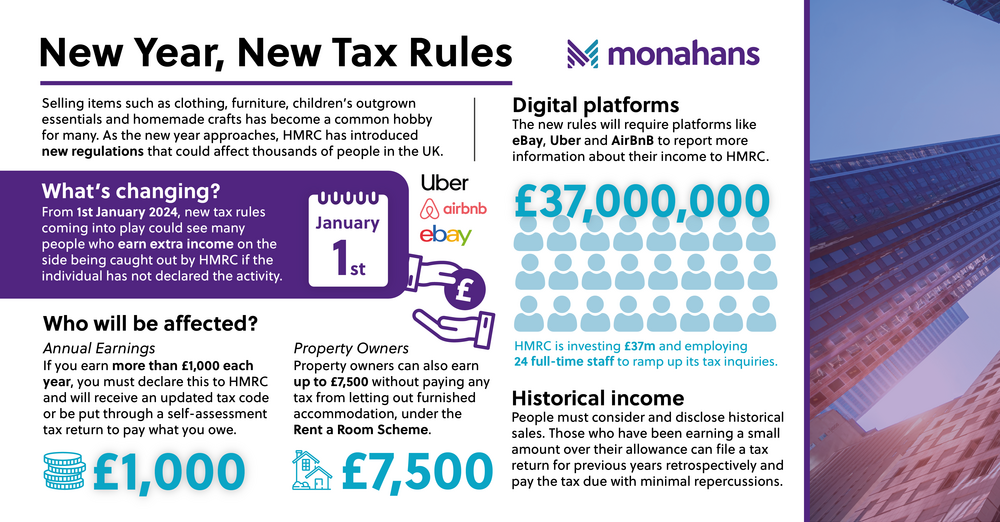

The new year is fast approaching and HMRC has introduced new regulations that could affect thousands of people in the UK. Selling items such as clothing, furniture, children’s outgrown essentials and homemade crafts has become a common hobby for many. In fact, a BBC article published earlier in the year reported that thousands more people have started selling things in online marketplaces to help pay their ever-growing bills, which has created a side hustle culture to help manage the cost of living crisis.

What are the new rules?

From 1st January 2024, extensive new rules come into play which could see many people who earn extra income on the side being caught by HMRC, if the individual has not declared the activity.

The new rules will require platforms like eBay, Uber and Airbnb to report detailed information about their income directly to HMRC. Before the changes, HMRC requested revenue figures on an ad hoc basis, but the new rules will require the companies to report this information as part of their general affairs. To cover all bases, overseas entities will also be required to report this information directly to HMRC, which will impact those who are selling items abroad using online marketplaces, as well as those who rent out properties such as holiday lets overseas.

Who will be affected?

For those who earn less than £1,000 each year through selling a few items here and there or baking cakes for friends – the trading allowance grants this level of income tax-free. However, if an individual’s income goes over the annual allowance, they must declare this to HMRC and will likely need to complete a self-assessment tax return to pay what they owe.

Property owners can also earn up to £7,500 without paying any tax from letting out furnished accommodation in their home, under the Rent a Room Scheme, so there is a small amount of flexibility.

To add pressure to the new rules, HMRC is investing £37m and employing 24 full-time staff to ramp up its tax inquiries. So those who fall within this bracket are encouraged to keep track of their activity. If HMRC requests a full disclosure and you are found to have made more than the allowances permit, tax, penalties and interest may be applied.

Does historical income count?

People must also consider historical sales and disclose these too.

HMRC has announced that it's not enough to start paying taxes from 1st January 2024 and avoid cleaning up historical tax underpayments. Those who have been earning a small amount over their allowance can file a tax return for the previous year retrospectively and pay the tax due with minimal repercussions and make voluntary disclosures to the Revenue where required. Whilst there is always a chance that HMRC will still issue penalties, contacting the revenue proactively will likely lower their severity. Those who do not make an effort to disclose the information may face greater penalties.

As with any case, responding to HMRC promptly and paying the tax you owe immediately will keep any fines to a minimum.

If there is any uncertainty around the new rules, people should speak to an advisor about their specific case to ensure that their tax affairs are kept in order. As we move into 2024, it will be more important than ever for taxpayers to ensure they are accurately reporting their income from all sources.

Get in touch with an expert today if you require further guidance on the latest rules.

Jessica Hunt