17 Jul 2023

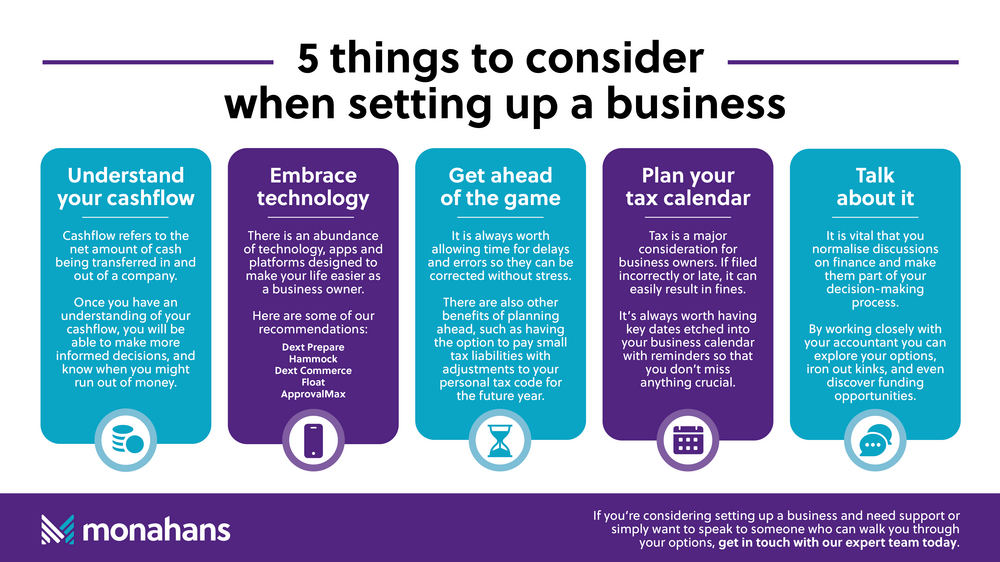

What to consider when setting up a business

Setting up a business is hugely exciting, but it can also be a daunting experience. It’s not always easy to know where to start and getting everything correct in the first instance will mean you aren’t forced to double back and make changes later down the line.

Many of the factors to take into consideration when setting up a business are just as important once the business is running, but you may not be as familiar with common terms, what they mean or why they are important.

At Monahans, our expert team understands how overwhelming it can be when first starting out and would always recommend speaking to an advisor who has a full picture of the business landscape and experience with helping new business owners to navigate it. However, there are a few golden nuggets of advice that we wanted to highlight here.

Understanding cashflow

Cashflow is one of those business terms which gets thrown around a lot, without much context. So, what does it mean?

The term cashflow refers to the net amount of cash and cash equivalents being transferred in and out of a company. Cash received represents inflows, while money spent represents outflows.

The reason that understanding cashflow is so crucial, is because of what it allows you to do. Once you have a thorough understanding of your cashflow, you will be able to run business-based scenarios which will give you greater clarity over the ‘what-ifs’ that are commonplace in business and work around any hurdles on the horizon. This will allow you to make better-informed decisions, and to know (in advance) when you might run out of money, or have surplus to allow changes such as expansion or key purchases.

Spending is a necessity, and understanding where your own expenses occur can highlight concerns before they morph into problems. There are several apps which can help you to understand your expenditure and its timing, which will uncover hidden issues, such as overspending.

Cashflow statements make up a critical part of a company’s financial statements, alongside balance sheets and income statements. Assessing the amounts, timing, and uncertainty of cash flows, is one of the most important objectives of financial reporting and is essential for assessing a company’s liquidity, flexibility, and overall financial performance.

Embrace technology

There is an abundance of technology, apps and platforms designed to make your life easier as a business owner – so why not embrace them from the get-go? For example, instead of using a spreadsheet to keep track of invoices, and only checking in every quarter, you could instead achieve the same result at the click of a button and be alerted at the first whiff of an anomaly. It’s always worth exploring your options.

In fact, we recently rounded up a summary of all of the best accountancy apps for SMEs.

Plan out your tax calendar

Tax makes the business world go around. It is a major and constant consideration for business owners, and if filed incorrectly or after a deadline, can easily result in unnecessary financial implications such as fines. As a result, it’s always worth having key dates etched into your business calendar with reminders so that you don’t miss a beat.

Often when people hear the word ‘tax’ it has negative connotations of dishing out precious funds. Whilst this can be the case in certain instances, there are plenty of rules and exemptions designed to give businesses tax relief. So much so, that it can be difficult to keep track. Tax guidance changes frequently, therefore it is always worth speaking to an advisor who can run through all available options to manage your tax effectively as well as giving guidance on how to plan around deadlines.

The early bird catches the worm

As with everything business related, the sooner you can start processes such as completing tax returns, the better, even more so if filing for the first time. It’s always worth allowing space for delays or even errors that can easily be corrected without unnecessary stress, provided you have given yourself plenty of time. There are also other benefits such as having the option to pay small tax liabilities with adjustments to your personal tax code for the future year.

There may be times when tax deadlines fall at challenging times. To prepare for such occasions its vital that you are aware of the options available and that you don’t take the knee-jerk reaction of burying your head in the sand. If you can set a precedent of facing any issues head-on from the very beginning, they will be prevented from snowballing into an unmanageable beast.

For example, many business owners may be unaware that HMRC have options to apply for payment plans online and to even pause payments if needed. It is therefore crucial to speak to HMRC at the earliest instance if you are having trouble paying, so that you don’t fall behind on taxes due and incur additional amounts in fines and interest.

Talk about it

One of the biggest errors that business owners, new and experienced, make is avoiding speaking about finances, particularly if a problem has been identified. In the UK we are notoriously bad about broaching the topic of money, but as a business owner it is vital that you normalise discussions from day one and make them part of your usual decision-making process.

By working closely with your accountant on things like business planning and financial planning, you can explore your options and iron out kinks. Determining the lay of the land is not only a worthwhile investment now, but also in the long-term life of your business. You might even find out about things you hadn’t considered, such as business grants or funding opportunities.

Being on top of your finances will empower you to make informed business decisions, based on where you are and where you want to be, rather than becoming a cause for concern.

As a small business owner, it’s not uncommon to come in on a Monday morning and find something on your desk that you were not expecting – not everything can be planned for. But if you understand your financial situation, your decisions can be based on fact rather than conjecture, and you stand the best possible chance of mitigating against issues and their impacts.

If you’re considering setting up a business and need support or simply want to speak to someone who can walk you through your options, get in touch with our expert team today.

Fiona Westwood