14 Sep 2022

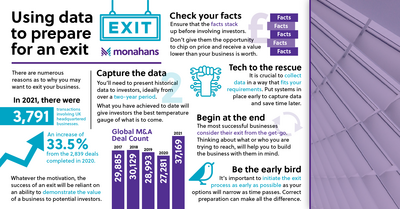

Using data to prepare for an exit

Monahans Technology Series – Article 3

There are numerous reasons as to why exiting your business maybe your chosen next step. You may be retiring and selling up or taking a partial exit to allow funding to come in, by selling some equity or listing on the stock exchange.

Whatever the motivation, the success of your exit will be reliant on your ability to demonstrate the value of your business to potential investors. Explaining your business is about telling a story; where you’ve come from and where you are planning to go. That story is what a potential investor buys into, and it becomes a lot more compelling when there is data to support the narrative, giving merit and substance to what is being said.

Capturing the data

To tell the complete story of your business you’ll need to present historical data, ideally from over a two-year period. Forecasts grounded in historical data will provide credibility, whilst allowing you to identify trends and carry out analysis.

Think about capturing this data from the outset. Consider what story you want to tell – what the value position of your business is – and then think about what type of data would support this.

For example, if you were operating a bakery and you required funding to open more stores, you would need to consider what that potential investor needs to know. For example, how much the set-up of your bakery cost, what investment you needed, how long it took for it to become profitable, how your customer base grew and what was needed in terms of staff to manage that growth.

These key operational and financial pieces of information will help an investor understand how long it might take for them to get a return but also to assess the riskiness of the investment. What you have achieved to date will give them the best temperature gauge of what is to come.

Tech to the rescue

Data capture needn’t be challenging but it is crucial is to collect it in a way that fits your requirements, for example, tracking your costs correctly. Record data in way that allows for easy formatting and analysis to support different aspects of your proposal.

This where technology comes into play. Many systems have the potential to talk directly to your accounting system and collect and display the information you need. For instance, you could have your point-of-sale system capturing KPIs and recording them in a Google sheet, which can then be linked to a system that is collating all this data to display trends in clear graphs and tables. You’re essentially compiling the information into an investment-ready package with minimal effort.

Putting systems in place early that run in the background to capture data will avoid the time-intensive exercise of pulling everything together later on, when you need to be putting your efforts into ensuring that the business is operating at its best.

Check your facts before involving investors

Regularly capturing and reviewing this information will not only give you invaluable insights into how to run your business better but will also allow you to check that the assumptions that you are working to make sense.

Ensure that the theories you are feeding into your story all stack up before involving investors. There is no value in telling an investor that if they give you X amount of money and you open X number of locations, they will make their money back in two years when in reality it has taken up to five years in the past.

The disconnect between expectation and reality is one of the main reasons why exits fall apart. If information comes out during the diligence process that you weren't aware of or that contradicts something else that you've said, regardless of how minor it is, it will demonstrate that there was something happening in your business you didn’t know about and will introduce doubt. This has the potential to either spook investors completely or give them a good opportunity to chip on price – resulting in you receiving a value lower than your business is worth.

Early bird catches the worm

As advisors, one of our challenges is to drive home the importance of initiating exit processes as early as possible. Many underestimate the scale of what is required, the difference that the correct preparation can make, and how quickly their options will narrow as time goes by.

Instead of diving in and creating statements which you are then scrambling to support with data that isn’t there, take your time in presenting a comprehensive and watertight picture of your business, which will you not be forced to backtrack on.

Beginning at the end

The most successful businesses consider their exit almost from the get-go. Thinking about what or who you are trying to reach, will help you to build the business with them in mind.

For example, if you want to eventually attract a particular company for investment, then you can use this as a lens to run every business decision through. Will a decision get you closer to that outcome? If not, is it worth doing? There may be decisions you’ll want to make regardless but having that aim as your north star will help you to remain on track.

If you need support in implementing sound data strategies when it comes to preparing for your exit get in touch with one our team today who will be more than happy to help.

Cara McGrath