16 Dec 2021

A Timely Exit: How to get the most out of your business

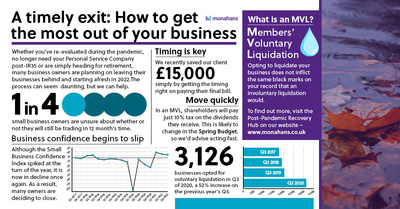

Lots has changed in the world of business over the last two years, and understandably, some owners have had enough. Whether it’s companies who have had the chance to re-evaluate over the course of the pandemic, contractors who no longer need their PSC (Personal Service Company) post-IR35 or simply those who are looking forward to retirement, we know several owners who are planning to exit their business.

In order to limit your final tax bill, access funds quickly and ensure the process is cost-effective, you might want to consider a Members’ Voluntary Liquidation (MVL). While ‘liquidation’ often carries a negative connotation, this can be the simplest way for business owners to exit a market and is certainly not something which carries any blackmarks if you wanted to start another business – in the way that an involuntary liquidation might.

It is, however, important to note that there are some anti-avoidance laws which prevent you from operating a similar business in the same market within two years. But, if you’re truly looking to exit the market and you want quick access to a large proportion of your funds, it could be for you. The key, however, is in the timing.

Make the most of 10% tax

Currently, shareholders who go through an MVL can receive dividends and pay only 10 per cent in tax. Most experts anticipate that this will change in the near-future, with many surprised that the Chancellor did not announce a rise in capital gains tax (CGT) in this year’s Autumn Budget.

If you’re thinking about winding up your business, we would recommend moving as quickly as possible, so that you get all of the existing advantage which could disappear in the Spring Budget announcement. Beginning an MVL is a fairly straightforward process, and shareholders can maximise funds in a matter of weeks. Get started in the months before the next budget in order to ensure that great tax rate.

Get timely advice

Another reason to consider the end of the tax year is that this can help you maximise your funds. We may recommend, for example, that a business take dividends at the end of one tax year, before starting the MVL process in the new tax year – which is of course only days later.

Additionally, if the company has a final tax bill, you may be entitled to a discount if you get the timing right. We’ve successfully reduced a bill by £15,000 for a client, simply because we were able to recommend the bill was paid early.

You should also ask your advisor when you will have access to funds. Though we can typically ensure funds are paid to shareholders within a matter of weeks, some financial service firms will not release any cash until the tax administration part of the MVL is complete. Because this part of the process involves HMRC, it can take several months. If you need quick access to your cash, make sure you ask this upfront.

Consider all your options

Part of our service is working with other finance professionals – for example your accountant – in order to ensure we maximise your gains. It might be beneficial to make pension contributions before MVL, for example, or to pay redundancies. We consult a variety of experts, whether that’s a Monahans accountant or you’ve been referred to us.

Alternatively, it might be that MVL is not the best option for your business. In which case, we’ll be able to help you come up with an alternative. Our goal is to help you find the next right step for your business, whatever that might be

If you’re ready to move on from your business, a voluntary liquidation could be right for you. For more information, help and advice, contact Steve Elliott.

Steve Elliott