8 Feb 2023

How can charities best navigate the economic crisis?

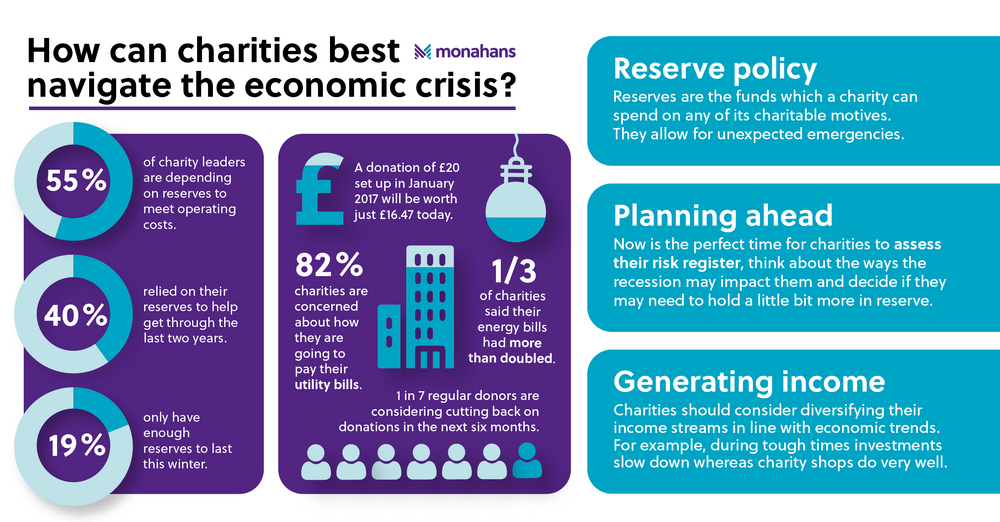

The rising cost of living and looming recession will likely be of concern across the charity sector. Here at Monahans, our team delivers a broad range of services designed to support charities, all of which you can view here. Our charity specialist and partner, James Gare, explains how charities should navigate the changeable economic climate.

The upcoming months present a lot of uncertainty and charities must put measures in place to negotiate the turbulent times ahead.

One of the key things charities need to get right is their reserves policy.

What is a reserves policy?

A reserves policy is a statement which outlines the level of free reserves a charity should aim to hold. Free reserves are the funds which a charity has available to freely spend on any of its charitable activities or overheads. When thinking about what is freely available to spend this would usually exclude:

- fixed assets that are held for the charity’s own use,

- amounts restricted by funders (restricted funds),

- amounts already set aside for essential future spending (designated funds)

Why are free reserves important?

Free reserves allow charities to manage unexpected emergencies or other unforeseen needs (such as an expected cost). Other reasons why having a buffer of free reserves is important include:

- To meet working capital requirements

- Being able to manage a restructure if grants are not renewed or are cut

- External changes requiring additional spend or reduced income

- Short-term deficits in budgets

- To “seed fund” a new project before other funds are made available.

Given that there may be financial challenges on the horizon with the cost of living and potential cuts to government funding– this may be a time to try and build up additional free reserves to weather these oncoming storms.

What should charities do to plan ahead?

Charities are under pressure to spend money raised promptly, yet they also need to ensure that they have adequate reserves to meet future costs. This places them in a challenging position, especially when they cannot be sure what will happen financially in the months or years ahead.

There is a difficult balance to find – putting too much money in reserve may tie funds up and limit spend on charitable activities. Too little creates risk to the charity’s ability to continue as a going concern, due to financial difficulty later down the line.

We often advise charities to set their policy on free reserves by considering the risks they are facing. For instance, if a charity has a lot of risk or relies on a low number of core funders, arguably they will need more reserves than lower risk charities who have multiple income streams.

Given that the macro risk landscape has been changing – it is a good time for charities to review their risk register, think about the ways that the economic landscape may impact them and decide if they may need to hold a little bit more in reserve for the next few years to help weather the storm.

Are there other ways to generate income?

Charities should also take this opportunity to consider whether they can diversify their income streams. For example, during a recession donations from the public are likely to contract whereas historically, income from charity shops do very well. Diversifying your income streams will not only help you to be more adaptive to quickly changing circumstances but also help you to manage financial risk.

Cutting your cloth

I also often suggest to my clients that, forecasting a ‘worst case scenario’ is a powerful financial tool. Understanding that in a worst case scenario, you could effectively restructure, as unpleasant as that might be, provides assurances to Management and Trustees that the organisation knows what needs to happen if things start going wrong.

Conclusion

Planning for the worst but hoping for the best is a useful adage as we potentially enter harder times.

Being equipped with a broad view of the risks, your financial headroom and your strategy if things go wrong will enable your organisation to choose the right path and of course, you can also contact me directly for help and advice.

James Gare