1 Mar 2023

Corporation Tax Changes – Are You Ready?

In the final Budget of 2022 it was confirmed that the main rate of UK Corporation Tax will rise from 19% to 25% with effect from 1st April 2023.

Corporation tax has been charged at a flat rate, regardless of a company’s size, since 2015 so it has been reasonably straightforward to calculate current and future liabilities and to plan cashflow accordingly. With effect from 1st April 2023, there will not only be a change to the headline rates of corporation tax but there will also be changes to the way in which the rates are calculated.

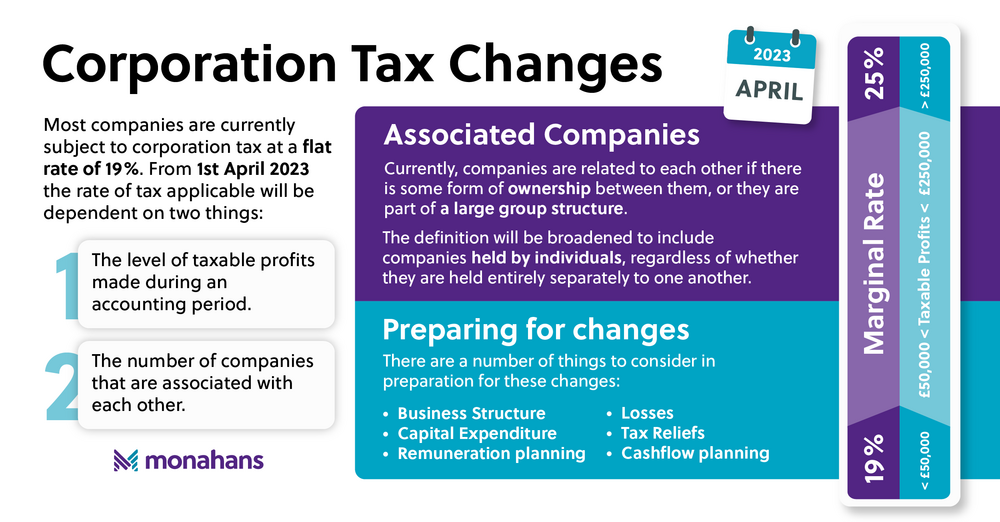

It’s crucial that businesses are aware of the nuances and pitfalls to look out for as we transition into new territory. Most companies are currently subject to corporation tax at a flat rate of 19%. From 1st April 2023 the rate of tax applicable will be dependent on two things:

- The level of taxable profits made during an accounting period, and

- The number of companies that are associated with each other

Our Corporate and Personal Tax Director Stephanie Hurst, reviews the changes and explains how businesses can navigate them.

The New Rates

From 1st April 2023 companies will be subject to the following rates of corporation tax:

- Taxable total profits of £50,000 or less - 19%

- Taxable total profits between £50,000 and £250,000 - Marginal Rate

- Taxable total profits more than £250,000 - 25%

The taxable total profit of a company is generally calculated by bringing together profits from all sources such as trading and property rental activities and deducting certain reliefs such as charitable donations and losses. Where profits fall within the marginal rate bracket the amount of tax payable by a company will start at 25% but will be reduced (where possible) by a marginal relief factor.

For a standalone company these changes are likely to be fairly straight forward to navigate but corporate groups and individuals with multiple enterprises should also note an important change to the definition of a related entity which is likely to have an impact on the rate of corporation tax applied.

Associated Companies

The headline rates of corporation tax are calculated based on lower and upper profit limits being £50,000 and £250,000 respectively. These limits are reduced by the number of ‘associated’ companies.

Very broadly, a company will be associated with another company if there is common control i.e. one company controls the other or both companies are controlled by the same person or persons. Based on current rules, companies will only be related to each other where there is some form of ownership between them, or they are part of a large group structure. From 1st April 2023, the definition will be broadened, and companies held by individuals, regardless of whether they are held entirely separately to one another, will need to be considered.

Companies within a large corporate group are likely to pay corporation tax at a rate of 25% due to the impact of their related entities but it is also possible that smaller companies could be subject to a higher rate of tax than anticipated if the individual shareholders of those companies have other interests.

Preparing for the changes

There are a number of things to consider in preparation for these changes:

- Business Structure – If you are part of a corporate group, can the group be restructured to remove smaller entities? Do you, as an individual, hold a number of smaller companies that you could consolidate or, if they are not required, wind up? Now is the time to consider the structure of your interests to understand how the rule changes affect you.

- Losses - Are you utilising these effectively? You can often have a choice as to what to do with excess losses, it may be more beneficial to carry them forwards if you expect to make significant profits in future.

- Capital Expenditure – For assets that qualify for the enhanced super deduction it will be worth ensuring that costs are incurred before the relief ends on 31st March 2023. Are you considering investing in something that only qualifies for Annual Investment Allowance? If so, it may be worth deferring this expenditure slightly if it will save corporation tax at a higher rate in future.

- Tax Reliefs - Are you making the most of reliefs such as R&D? Could you make employer pension contributions? Review your position to ensure you’re making use of reliefs appropriate to your situation.

- Cashflow planning - The changes may mean you will need to pay more tax in future and, if you fall into the quarterly payment regime due to the change in associated company rules, potentially sooner than usual.

Review your position ahead of the changes to ensure that your business has enough money set aside to deal with general and unexpected expenses. Read more about the power of correctly managing your cashflow in our article.

- Remuneration planning – Can any planned bonuses or large salary expenditures be slightly delayed and paid when the rates have changed? Are you drawing your income from your company in the most efficient way? It may be worth reviewing how you extract your income from your business.

Ultimately these changes are coming and are likely to impact all but the very smallest of enterprises.

Understanding where your business stands and planning ahead will be key in navigating these changes. If you would like any advice or guidance relating to the impact of these changes on your business, please get in touch with Stephanie or one of the team today.

Stephanie Hurst