5 Apr 2023

Seed Enterprise Investment Scheme – Changes from April 2023

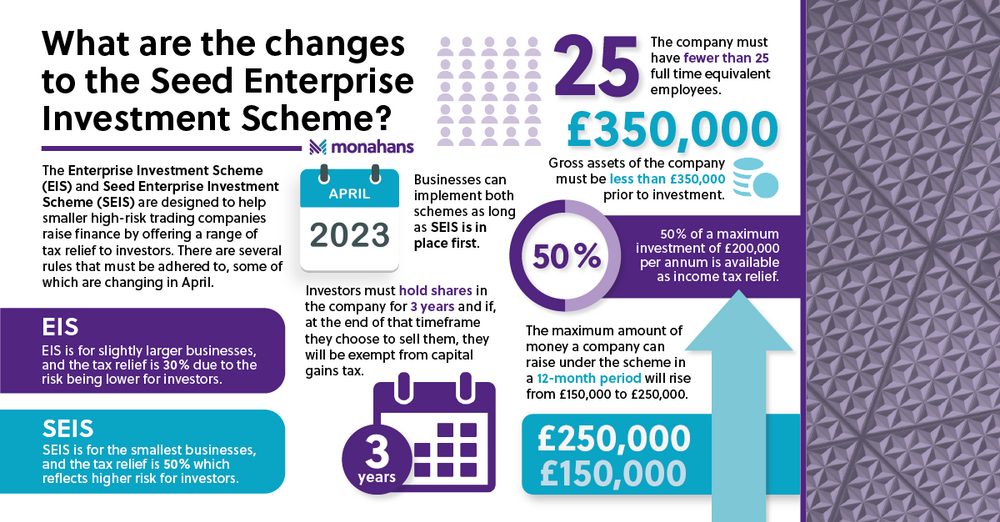

The Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) are designed to help smaller high-risk trading companies raise finance by offering a range of tax relief to investors. There are several rules that must be adhered to by both the investor and the company for either scheme to be successful and to retain any relevant tax reliefs, but they can be beneficial to many if utilised correctly.

Stephanie Hurst, corporate tax consultancy and personal tax compliance director, explains the current rules and the changes coming into play for the SEIS regime in April 2023.

Where are we now?

The SEIS regime began in 2012 as an initiative to help the very smallest of start-up businesses by offering significant tax benefits to external investors.

There are certain conditions that must be met by the company and the investor in order to unlock these benefits and there are a few restrictions applicable to the size of company that may apply to use the regime. More detailed information on the SEIS regime can be found on our website here but some of the key conditions and reliefs available include:

- A company must have fewer than 25 full time equivalent employees

- The maximum amount of money a company can raise under the scheme in a 12-month period is £150,000

- A company must have been carrying out a qualifying trade for less than 2 years prior to investment

- An investor may only claim tax relief on up to £100,000 of investment

- A company must have gross assets of less than £200,000

As part of the UK government’s growth plan several changes will be made to the SEIS regime from April 2023 to encourage even more investment into start-ups.

What’s changing?

Many of the current SEIS conditions relate to the size of a qualifying company and the level of investment an individual can make. A number of these limits will be raised from April 2023.

Some of the key changes include:

- The maximum amount of money a company can raise under the scheme in a 12-month period will increase from £150,000 to £250,000

- A company must have been carrying out a qualifying trade for less than 3 years prior to investment

- An investor may claim tax relief on up to £200,000 of investment

- A company must have gross assets of less than £350,000

With the limits on the SEIS regime increasing, it is looking much more attractive for small businesses to utilise the scheme, especially those at the very beginning of their journey.

The changes are also exciting for serial investors who are looking to invest in multiple start-ups. However, it’s important to remember that whilst investing in these types of businesses could provide you with some significant tax savings these investments are generally high-risk so advice from a financial adviser is usually recommended.

How will this help small businesses?

At a time where finances are tight, the SEIS regime offers an appealing option for start-up businesses to consider because, if played right, they can reap substantial rewards. It is a sensible alternative to bank loans and other kinds of investments which are appearing increasingly detrimental in the turbulent times that lie ahead, especially with interest rates rising.

Even though the company must give away part of its share capital for any investment it will receive the opportunity to benefit from having experienced investors on board for advice, expertise, and potentially more advanced resources in the industry in exchange – likely a worthwhile trade

If businesses structure things in the right way they can potentially benefit from the SEIS and the EIS regimes but only if the SEIS scheme is implemented first. If you have already used EIS to raise funds unfortunately the change in these rules won’t be of benefit to you.

These regimes are becoming increasingly attractive for very small companies, especially those in the tech industry as they could, for example, significantly help with the funding of development projects. It should be noted, however, that there is a very strict application process and any business wishing to make an application to use either of the regimes will need to make sure they dot their I’s and cross their T’s before moving ahead.

Monahans can help you structure your business to ensure you make the most of these regimes. If you would like any advice of guidance on understanding how your business can utilise these schemes, please get in touch with Stephanie or one of the team today.

Stephanie Hurst